- ፍራንክ Digest

- Posts

- 🚀 Shoot For The Moon

🚀 Shoot For The Moon

PLUS: A Great Year...Ruined.

Welcome to the 83rd edition of ፍራንክ Digest!

Your weekly brief on all things Finance and Investing. Quick, enjoyable reads for busy professionals in 5 minutes or less.

Here’s what’s coming your way:

☁️ Waking Up To The Ethiopian Dream

🔎 Big Revenues, Bigger Losses for Ethio Telecom. Whodunnit?

🖼️ The Big Picture

Thanks for reading!

The Ethiopian Dream

Jubilee Palace

Personal Finance

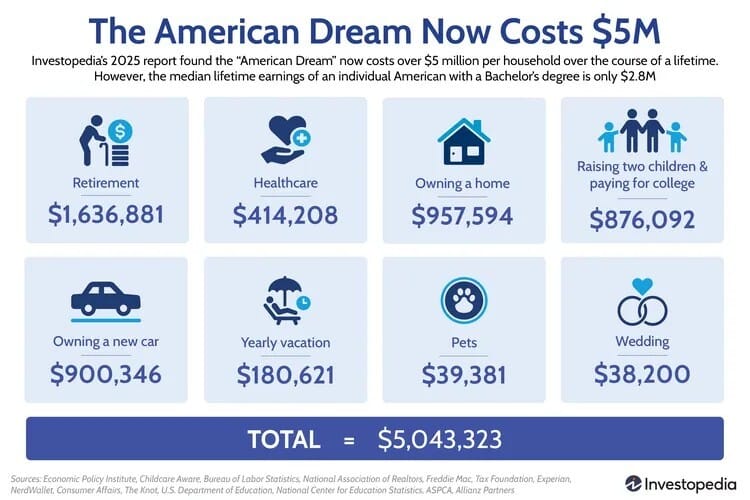

The ‘American Dream’ now costs more than USD 5 million over a lifetime!

That includes housing, retirement, healthcare, education, transportation and even leisure. While the price tag comes from the U.S., the idea behind the study makes us think how relevant all of this is to the Ethiopian context.

In Ethiopia, the dream looks different, and so do the numbers.

Sure, many Ethiopians picture a fulfilling life that includes a modest but comfortable home, children who can access quality education, reliable healthcare, stable income, community connection and perhaps the possibility to build a business.

The journey however is shaped by double-digit inflation, currency dives and constantly changing public services. In ways that are less common in the U.S., strong family networks in Ethiopia often offer support.

Housing: The First Big Boss Fight

Illustrates the contrast between the two countries sharply. While an average U.S. home costs nearly USD 1 million, a two-bedroom apartment in Addis Ababa might cost around USD 100,000 (approximately ETB 17 million), with villas in prime neighborhoods reaching closer to USD 1 million.

Raising Kids

This brings another layer of comparison. In the U.S. model, the lifetime cost of raising two children is tremendous. While college loans are available for the children to bear themselves.

In Ethiopia, public school options make education far more accessible, though many parents dream of private or international schools, where fees can be substantial. Families often share childcare duties, reducing certain expenses like nurseries and after school activities. Ethiopian parents frequently adopt a phased mindset focusing first on high school education, then reassessing later pathways based on opportunities, scholarships and the child’s personal direction.

ጤና ጥበቃ: Less Insurance, More Reality-Checks.

While the U.S. system relies heavily on insurance and large lifetime medical expenses, many Ethiopians depend on public hospitals or private clinics when needed. The system is improving, yet out-of-pocket costs can still alarm families during emergencies. Preventive care and modest monthly contributions to health insurance can significantly reduce vulnerability, but financial preparation remains critical.

Transportation: One Car, Many Decades

This too, tells its own story. In the U.S., the American Dream assumes the purchase of several new cars every 5 years. Ethiopia, on the other hand, faces high import costs and limited financing options. Many people rely on public transport or second-hand cars. It’s common to keep a car in the family for 20+ years. The government’s shift toward incentives for electric vehicle ownership may eventually reduce costs, but for now, the Ethiopian Dream rarely depends on owning multiple new cars over a lifetime.

Leisure and Pleasure

Carries cultural importance in both countries, but with different degrees of importance. Americans, according to studies, set aside hundreds of thousands of dollars over a lifetime for vacations.

Ethiopians tend to take shorter, local trips. Visiting family, traveling to cultural or religious sites domestically for መስቀል or ኢድ አል አድሃ. And the occasional prayer circle for a visa approval.

Weddings, which can become very expensive relative to local incomes, are still often community-funded through contributions and reciprocal support.

Frank’s Take

What makes the Ethiopian Dream unique is the strength of social networks. Family, friends and neighborhood communities help reduce costs during major life events. While this support system cannot replace formal financial planning, it does form a powerful safety net and makes certain milestones more achievable than raw financial calculations would suggest.

Big Picture

The first step is to define what your personal dream actually is.

Not every Ethiopian wants a villa, two cars and annual international travel. Some dream of building ጫካ ፕሮጀክት while for others it’s sending their children to a solid school or saving enough to retire peacefully in the countryside. Clarifying this vision creates a foundation for practical planning.

Once your dream is defined, estimate what each element will cost today.

If owning a home is your priority, research current prices or construction costs. If education matters most, map out the likely expenses for the school system you prefer. If running a business is central to your dream, determine your starting capital and expected operating costs. These numbers don’t need to be perfect; they simply guide your planning.

With a clear target, begin building a savings and investment strategy.

Consistent long-term saving can create a surprisingly solid income base. Some Ethiopians rely on property rental or small businesses. The key is to establish at least one dependable source of future income not tied to daily work.

Don’t forget to celebrate the milestones your first meaningful savings, the beginning of construction, a child’s school enrollment or your first investment return.

ፍራንክ Picks

🗞️ In the news: Dividends galore but EIHs 10B payout raises accounting concerns

♟️ Innovation: Here’s Ts’ega, real time updates for stocks and bonds

The Birr is Glamorous, But A Bad Currency

Investing

The Story In Three Lines

→ Ethio Telecom’s year looked solid on the surface; revenue up, subscribers up, services up.

→ But the birr had other plans, wiping out 42.6 billion birr of income through FX losses alone.

→ Compared to private banks enjoying record profits, Ethio Telecom’s financials look bruised

If our “Bankers Are Smiling For The Camera” article taught us anything, it’s that Ethiopia’s financial and investment landscape has a strange sense of humor.

Private banks printed record profits thanks to the July 2024 devaluation in a sort of “Congratulations, your US dollars just got promoted!” moment. Ethio Telecom, however, experienced the same macro story from the opposite side of the chessboard.

While banks were celebrating dollar assets suddenly bulking up, Ethio Telecom was discovering what happens when your liabilities are in dollars and your income is in birr.

Spoiler: it’s not great.

It’s like returning to buy something you checked yesterday, only to find a fresh sticker on top of the old sticker, on top of another old sticker.

A Strong Year… Until the Birr Showed Up

Operationally, Ethio Telecom actually had one of its strongest years in a long time.

Revenue climbed from 91 billion to 148 billion birr.

Customer numbers grew.

Data traffic surged.

Mobile money expanded.

Safaricom Ethiopia is still very much the enthusiastic but small newcomer trying to find the bathroom light switch.

In short, the business itself isn’t the problem.

But then the birr depreciated

And suddenly, 42.6 billion birr of Ethio Telecom’s income vanished into accounting smoke. Or did it appear in an accounting nightmare? We’re not accountants, so it’s a bit confusing, but the point is that’s a 1,400% jump from just 3 billion in FX losses the previous year. Wild, but real.

It gets worse: remember that big share sale last year? The one where 100 million shares were offered and only around 10% were taken up? At the time, everyone thought the marketing was off, or the paperwork confusing, or perhaps blamed mercury retrograde.

But now, looking at this year’s numbers, it’s quite clear investors weren’t being shy, they were being smart. Ah! Wise (typically conservative) Ethiopians.

While most banks have been offering Earnings Per Share (EPS) between 30–70% for years and announcing record revenues left and right, Ethio Telecom’s EPS of 5.79 Birr per share translates to a ridiculously low 1.5%.

Wise Ethiopians indeed.

Not Mismanagement, Just Realities

To be fair, Ethio Telecom’s problem isn’t mismanagement. It’s exposure. Years of network expansion, vendor financing from Huawei, ZTE, Ericsson and friends, and dollar-denominated loans means the company’s earnings in Birr, in all its its dramatic mood swings, simply can’t satisfy those obligations.

In other words: great business, terrible macro timing.

But before we exile Ethio Telecom to the “bad, bad company” corner, let’s slow down. Without any additional major policy earthquakes forthcoming, Ethio Telecom has every opportunity to rebound.

After all, we’re talking about:

A near-monopoly in a sector where demand growth shows no signs of stopping.

A customer base that complains loudly but really has nowhere else to go.

A digital ecosystem (mobile money, enterprise services, cloud) just getting warmed up?

A market where telecom demand is young, expanding, and deeply underserved.

Frank’s Take

Yes, banks had a phenomenal year.

Yes, Awash, Zemen, Wegagen and others all reported monster profits.

Yes, EPS numbers are making shareholders giggle like adults who absolutely shouldn’t be giggling at numbers. But here we are.

They might be enjoying their inflated profits today, but their magic trick is unlikely to repeat next year (At least not to this extent). As we noted in our earlier article, much of that “growth” came from FX translation magic, not banking genius.

Ethio Telecom’s pain, meanwhile, is also largely from the same exchange-rate shock, just on the wrong side. If the currency stabilizes even a little, the company’s numbers should look far more normal next year.

Put simply: the banks’ glow-up is temporary. Ethio Telecom’s bruises are also temporary. But the fundamentals of the telecom sector (scale, growth, and demand) are permanent.

Thanks for sticking with us, ፍራንክ family! Keep those wallets smart and your inbox open - we’ll be sliding in next week!

Reply